- Products

IP PBX and Call Center

Credit Card System

Vistual Agent

CRM System

Odoo ERP

Business Suite

POS

SAAS - Franchise - Customizable

- Services

- Online Marketing

- App Developer

- Cloud Services

- Resource

- Support

- High Security

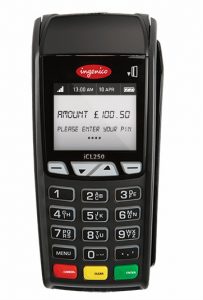

- Accepts All Forms of Payment

- Designed for Merchants

- Convenient and Reliable

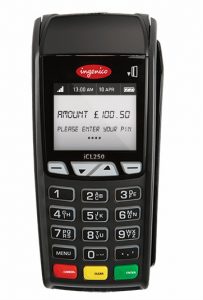

- Lightweight

- Fast and Secure

- Fast Processing

- Easy to Use

- Reliable Functionality

- Ergonomic keypad

- Lights and audio cues

- Full color touch screen

At SW Merchant Services Group, we know how important a Point of Sales information system is for a retailer and restaurant owner. It is critical for gathering and applying information effectively in today’s ultra competitive markets.

A Point of Sales (POS) system can help make restaurants or retailers more profitable while improving customer service, resulting in a loyal customer base. With our professional support staff you will be on the cutting edge for point of sale processing specifically designed for restaurants, retail, and hospitality establishments.

Clover Station

Posted on June 6, 2018

Body

Dimensions

Max Height

Screen

Weight

Payments

Hub

Security

Processor

Brushed aluminum with white glass accents

Base plate: 11.0″ x 7.5″

Max. height from countertop to display top: 9″

14-inch Display with full HD resolution (1920 x 1080) and patented swivel feature

Device & Hub: 5.0 lbs

Magnetic-stripe, EMV chip, and contactless payments (Apple Pay®, Google Pay® and Samsung Pay®)

4 USB ports to connect peripherals, 2 Cash Drawer ports

PCI PTS 5.0 certified

Mobile processor with 8-cores; 4GB RAM, 16GB ROM

Clover Mini

Posted on June 6, 2018

Integrate

Payments

Body

Display

Mini Wi-Fi device

Device + Hub

Clover Mini Wi-Fi + 3G device

Device + hub

PCI Compliant

Clover Mini Wi-Fi Ethernet

3G (Pentaband HSPA+)

Power Source

Screen

Hub

Options

Including Clover® Mini, Clover® Flex, Clover® Go, and Clover® Station

Contact us today to learn how you can get started with Clover®. 1.866.477.8088

Clover® Point of Sale

Clover® makes it easier and faster to accept the latest payments. Clover® can help you manage inventories, products, employees and engage with your customers effortlessly. Clover® is customizable, so you can have a system that fits your business’ needs.

Clover® Station

The Clover® Station is perfect for larger restaurants or retail establishments. The Clover® Station is designed to manage complex inventories. Connect the Clover® Station with accessories like kitchen printers, barcode scanners, cash drawers, and more for additional functionality.

- 14-inch display with full HD resolution (1920 x 1080) and swivel feature

- Magnetic-stripe, EMV chip and contactless payments

- Sleek, minimalist design

- Wifi or Ethernet connection

Clover® Mini

The Clover® Mini is ideal for small businesses. The Clover® Mini can be used in conjunction with the Clover Station, or as a standalone device. The Clover® Mini has a built-in printer and Antimicrobial Corning Gorilla Glass display. This sleek and compact device will meet your business needs without additional hardware or accessories.

- 7-inch Antimicrobial Corning Gorilla Glass display

- Built-in receipt printer

- Magnetic-stripe, EMV chip and contactless payments

- Wifi or Ethernet connection

Clover® Flex

The Clover® Flex is the newest addition to the Clover® family. This device is a hand-held device that you can easily take with you and hang to customers so they can dip, swipe, tap, enter a pin and sign. Checkout where you are with the Clover® Flex.

- 5-inch Antimicrobial Corning Gorilla Glass display

- Built-in receipt printer

- Magnetic-stripe, EMV chip and contactless payments

- Wifi or 3G connection

The Clover® trademark and logo are owned by Clover Network, Inc., a First Data company. All other trademarks, service marks and trade names referenced in this material are the property of their respective owners.

GIFT AND LOYALTY PROGRAM

Looking for ways to grow your business? With our gift and loyalty program, SW Merchant Services Group gives merchants the advantage of offering an in-house gift and loyalty solution directly to their customers. SW Merchant Services Group’s gift and loyalty program is ideal for small to medium-sized businesses looking to increase revenue with an additional product, and gain both loyal and new customers all at the same time.

Gift card recipients typically spend more than the value of the card and often make multiple purchases with their card.

WITH SW MERCHANT GIFT AND LOYALTY PROGRAM, YOU CAN

Build Brand Awareness

Build Brand Awareness

Build Brand Awareness

Build Brand Awareness

Let us help you get started with an e-commerce site. It's a quick and simple way to start accepting credit cards online and make more sales.

SW Merchant Services Group helps merchants accept credit cards online with secure e-commerce Payment Gateway and services that make accepting electronic payments quick, easy, and safe, allowing you to accept credit cards from websites. Our solutions are designed to save time and money for small to medium-sized businesses.

EBT is here! If you are a Snap Retailer we have good news for you!

EBT (Electronic Benefits Transfer) is an electronic system that allows a recipient to authorize transfer of their government benefits from a Federal account to a retailer account to pay for products. EBT is as easy as accepting Debit Cards.

- You no longer give change back to EBT Food Stamp Recipients

- New faster in-store way to make transactions

- You no longer give change back to EBT Food Stamp Recipients

- New faster in-store way to make transactions

SW Merchant Services Group is recognized by the USDA and is listed on the SNAP EBT Third Part Processor List.

If your business offers qualifying benefits, then the ability to accept EBT (Electronic Benefits Transfer) payments is another option to increasing your revenues. Customers on government assistance may represent a portion of your clientele. Your business could benefit from offering EBT payment options.

Call us at 1(866) 477-8088 to get more information about EBT.

SW Merchant Services Group offers comprehensive PIN-based, PIN-less, and signature-based debit card processing. By allowing debit card customers to use their bank ATM cards and check cards to pay for goods and services, the transactions that are ran with these cards allow for the card holder to immediately pay for the item instead of paying the amount at a another time like a credit card.

What is PIN-based, PIN-less, and signature-based debit?

■ PIN-based transactions occur at the point of sale and are defined by the entry of a PIN (Personal Identification Number) by the cardholder. Also referred to as online debit.

■ PIN-less debit transactions are conducted without the cardholder present and are generally used only in processing environments with recurring transactions, such as utilities or other bill payments.

■ Signature debit, also referred to as offline debit, is the use of a check card issued by a bank. During the transaction, the cardholder can elect to use the card as Debit (PIN-based) or Credit (Signature-based).

With TeleCheck services, you get it all; the ability to process all major credit/ debit cards and even accept checks.

How does it work?

The check is authorized through the capture of banking information and the amount of the check. After approval, the customer will receive a receipt of the transaction to sign. Once signed, the customer receives a copy of the check.

Features and Benefits:

- Streamlines your business by processing all major credit/debit cards and checks on a single terminal

- Provides both total and detail reports on all payment types

- Integrated reader supports 300-dpi check imaging, stores up to 300 credit/debit and 500 check transactions

- Dual-track magnetic stripe reader reduces errors and saves time

- Large, back-lit display and touch screen is easy to read and use

Visa® Acceptance Artwork

MasterCard® Brand Center

Discover® Signage & Logos

American Express®

JCB® Emblem Download

EMV chip technology is becoming the standard for credit card acceptance. Consumers will be looking for a secure payment option. Let us help you get started!

EMV stands for Europay, MasterCard, and Visa. It is a global standard for processing credit cards with integrated chip cards. EMV can provide a secure platform for merchants who want to accept credit cards as a form of payment for their goods or services.

New payment options are developed to combat fraud, by using an extra layer of security read on the chip. Let us help business owners, like you, continue to accept credit card payments securely with the support of EMV functionality.

The smart chip card technology and contact-less payments make it easier than ever for card holders to make purchases from your business. This enhances and ensures that the card holder’s card information is secure.

Benefits of Europay, MasterCard and Visa

- Fraud Protection

- Reduce Chargeback Risks

- Peace of Mind

A proactive approach to preparing your business for the new technology of EMV acceptance at your business is what consumers will be looking for to accept secure and different payment options.

It’s never been simpler. You can accept credit cards in the palm of your hand. Turn your cell phone into a sell phone.

SW Merchant Services Group offers a variety of product applications and services that can empower your business. Turn your mobile phone into a mobile POS terminal. Mobile payments enables merchants to take their business to new technological levels. It is simple, secure, and allows you to swipe a card directly on your mobile device.

A proactive approach to preparing your business for the new technology of EMV acceptance at your business is what consumers will be looking for to accept secure and different payment options.

- Mobile Card Acceptance – you can take card payments wherever you are, at any time, through your mobile phone, and it is just like swiping a card at a terminal.

- No Additional Phone Line Costs – with AprivaPay Plus you use your existing mobile device; therefore no additional phone line is required.

- Secure and Safe – AprivaPay Plus is PCI and PA-DSS compliant and all credit card details are encrypted and transmitted using industry standard SSL.

- Easy to Set Up – Complete a simple step setup process and you will be ready to start accepting credit card payments.

■ What is a Merchant Account? A Merchant Account enables you to process credit cards, debit cards, gift cards, and electronic check transactions. These payment methods are convenient for your customers and they help you get paid faster.

■ What types of businesses can set up a merchant account? We accept Retail, Restaurant, MO/TO, and Internet/ E-Commerce.

■ What credit cards will I be able to accept? We set you up so that you can accept all major credit and debit cards including MasterCard, Visa, Discover, American Express, and bank ATM debit cards.

■ Do I need a business license? Yes, you do need to have a business license, trade name registration, DBA certificate, etc.

■ What is the Address Verification System? The Address Verification System (AVS) lets you enter the customer’s home address and compares it to the address on file with their credit card company. If someone uses a stolen card and wants products shipped to a false address, AVS will detect this for you.

■ How will I get my money? Your funds will be deposited directly into your current business checking account on file. Typically between 24-48 hours (sometimes slightly longer if your business is considered high risk). If you ever need to update your bank account,

■ How long does the approval process take? Most accounts are approved in 48 hours once all necessary paperwork is received. After approval, we will immediately inform you of your acceptance and deliver the terminal equipment or software.

■ When do credit card transactions get funded? Funds generally get funded within 48 hours after settling the terminal.

■ How will I get my money? Your funds will be deposited directly into your current business checking account on file. Typically between 24-48 hours (sometimes slightly longer if your business is considered high risk). If you ever need to update your bank account,

SW Merchant Services Group offers tips on fraud protection. Consumers are very concerned about credit card theft. Credit card fraud is something that can never be completely eliminated, but can be managed through practices by the merchant. Here are preventative tips that can you can perform to limit credit card fraud.

An authorization on a credit card does not mean you are safe from fraud.

Approved authorization does not guarantee payment. Approval only indicates that at the time of purchase, the card hasn’t been reported stolen/lost or the card limit has not been exceeded. If someone is using the credit card illegally, the card holder can dispute the charges.

Always get an Address Verification.

Using AVS (Address Verification System) is easy to decrease the chances of accepting a stolen credit card. When you process a credit card transaction; make sure you get the card holder’s billing address and zip code. Manual non-swipe transactions will require you to get card holder information. However, card present transactions will not. Once you get the card holder’s billing address and zip code you’re ready to process the sale.

Always use Card Verification Methods (CVM).

Card Verification Value (CVV) is the three-digit code on the back of a credit card (four digits for American Express). The card holder’s CVV code is verified by the card issuing bank when the credit card sale is being processed. If you do not receive a CVV match you should consider declining the transaction. Online merchants should make CVV a required field.

Be wary of different “Bill” and “Ship To” addresses.

Require anyone who uses a different “ship to” address to send a fax/email with their signature and credit card number authorizing the transaction. If the billing and shipping addresses are different, request telephone numbers for both addresses.

Be extra careful with International Orders.

It is very difficult to retrieve goods or apprehend fraudsters after they have left the country. Always inspect the orders that are being shipped to an international address. Pay more attention if the card or the shipping address is in an area prone to credit card fraud.

A CHARGEBACK occurs when the funds paid into the merchant account are reversed and refunded to the cardholder. The chargeback documentation can tell you why the cardholder is disputing the transaction.

In most cases, Cardholders are given 120 days from the date of the transaction to make a claim. In addition to the reversal, the merchant is typically charged a service fee for the chargeback. Sometimes the bank will issue a chargeback before you receive notice of the claim. Unmerited “disputes” are common and most instances are settled in favor of the cardholder. Chargebacks can cost the merchant additional fees and if they occur too frequently, can jeopardize merchant account.

Here are a few tips on how you can minimize the chances of getting a chargeback:

Check the cardholder’s signature; compare the first letter and spelling of the surname on the receipt with the signature on the card. If a customer’s card is unable to be read, this may be a sign of fraudulent activity or stolen account number. Ask the customer for a different form of payment. Avoid manually keying in the card, as this may put the merchant at risk of a chargeback.

Use a manual imprinter (not pencil, crayon, or any other writing instrument) to capture the impression of the card. Even if the transaction is authorized and the receipt is signed, there is still a chance that fraud may occur.

When the customer’s shipping address and the credit card billing address do not match, you have the right to contact the customer to ask him/her to explain the difference.

Make sure the transaction information on the receipt is legible, complete, and accurate. In any chargeback case, you will have to fax/email the receipt to the bank and if the receipt(s) is illegible, you may lose the case just based on that fact. It is also very important to manage the customer’s expectations upfront, document your efforts and work directly with the cardholder to resolve misunderstandings or conflicts. Our goal is to help resolve these disputes in the merchant’s favor. Please note that all remedies to a chargeback must be in compliance with the Card Association rules and regulations.